3 Commonly Shared Opportunities, and Challenges, for the Future of Impact Measurement & Management

In many of my recent conversations with investors, I have been struck by some consistent themes that continue to come up as it relates to our vision for more effective impact measurement and management. The good news is that there is clear consensus, and that most investors share the view that a more transparent and collaborative impact investing ecosystem is what is needed to move capital to high-impact opportunities to ultimately drive positive change. There is also consensus as it relates to the obstacles that we will face to achieve this vision, and as such, some question around how we can work together to make this vision a reality. Here are the opportunities and associated challenges that I continue to hear from investors when it comes to more effective and efficient impact measurement and management.

The desire for standard metrics vs. the reality of company specific metrics

All investors share a desire for standardization of metrics wherever possible. With standard metrics, investors can avoid “reinventing the wheel”. However, investors also recognize that there is great nuance and complexity in this work, and the idea that you can compare most portfolio companies on an apples-to-apples basis, even within similar impact themes, is not realistic. Moreover, in the event that investors try to make standard metrics work, there is a tendency to push to the lowest common denominator (e.g. lives impacted.) While this approach lends itself to data aggregation, it can often make the act of impact measurement meaningless. With this in mind, there is general consensus that custom metrics at the individual company level are also important. Many investors are identifying a hybrid approach which includes a list of standard metrics for certain areas of their investment theses, as an example, jobs created at portfolio companies post investment, as well as custom company-specific metrics which account for nuance that is required to measure meaningful impact. With this in mind, flexibility when it comes to impact data analysis and reporting is incredibly important.

Standards alignment vs. year over year data

Investors share that in moving away from previously used standards to those that are being used by their peers allows for industry benchmarks. Without benchmarks, this data lives in a vacuum, and by sharing and, perhaps more importantly, adopting commonly used metrics, we will all benefit from industry benchmarks which provide us with a sense of how we are doing as compared to our peers. At the same time, shifting away from previously used metrics to adopt someone else’s would mean that investors would no longer benefit from year over year data, which is very compelling to report as it can show trends and ideally growth. These desires are at odds with each other and investors will have to reconcile one of these things to achieve the other.

The need for quantitative data vs. the importance of qualitative data

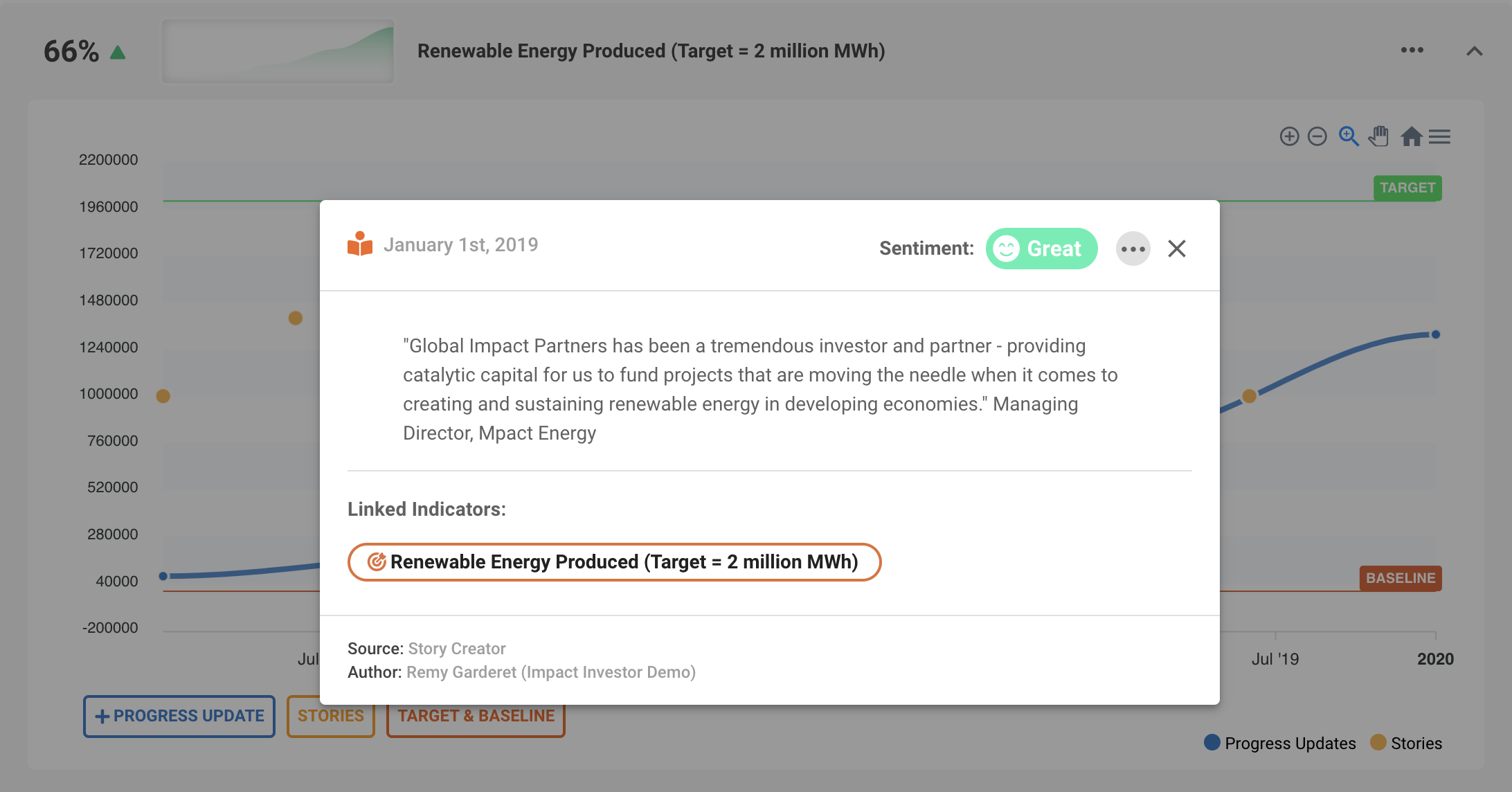

Investors all acknowledge that we need quantitative data to inform investment decisions, track progress towards goals, and report the impact that they are having across their investments. In addition, investors realize that this work is more than just numbers and graphs, and that qualitative data is crucial to understand why the work matters. Without it, and the context it provides, outputs are merely numbers. Questions remain how to collect both quantitative data and qualitative data from the right constituents, without create unnecessary burden. In addition, investors know that the most compelling impact reports include both quantitative and qualitative data but how to effectively marry the two is still unclear. At UpMetrics, we have intentionally designed the platform (like in the dashboard below) to enable connecting quantitative and qualitative information in a digestible way.

While there are certainly unanswered questions, the good news is that most investors want the same things when it comes to impact measurement and management. What is needed now is for leaders in this space to come together and align around next steps. When this happens we will all be closer to benefiting from things like standardization and industry benchmarks, while also incorporating important nuance and context that comes from custom metrics and stories that are required to measure and share meaningful impact data.

Tags:

June 29, 2022